James Bullard, Speech: The Prospects for Disinflation in 2023

Fed Funds

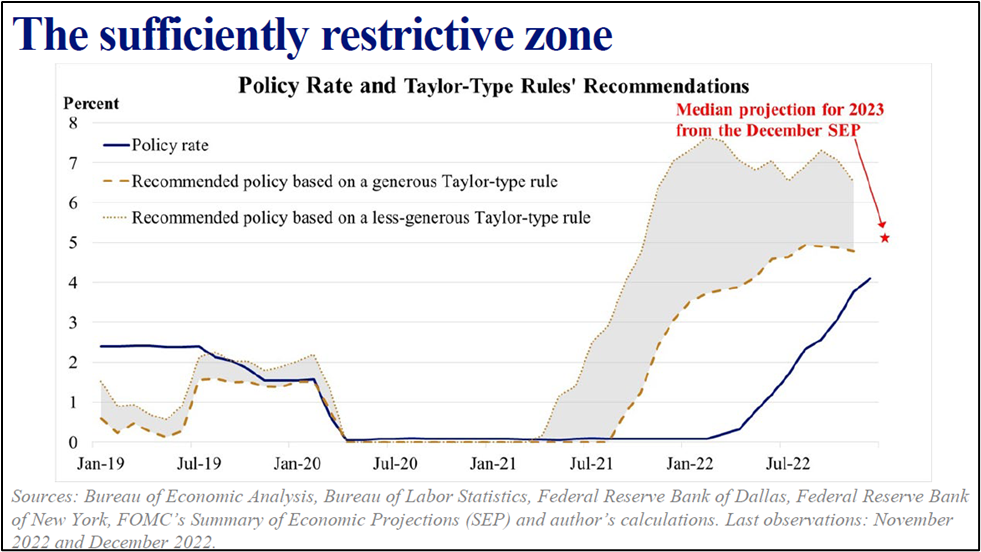

“The policy rate, our policy rate of the FOMC is not yet in a zone that might be considered sufficiently restricted, but we are getting closer.”

“Now, is the policy rate at the right level? The committee stated in our statement that we wanted to get to a level of the policy rate that was sufficiently restrictive … . And it’s not in the zone yet, but it’s quite a bit closer than we have been over the last year or so. And so we’re getting closer to sufficiently restrictive, but more importantly, I think it shows that it looks like we’re going to catch up and actually be in the right place with the policy rate in the zone that is sufficiently restrictive during 2023.”

- Bullard’s chart shows a sufficiently restrictive rate between 4.75% and 6.75%.

GDP

“Perhaps the best interpretation is that GDP growth is slowing to be in a neighborhood just below the potential growth rate of about 2% on a year-on-year basis after stellar growth in 2021.”

Inflation

“So I’m not sure we’ve really seen convincing evidence at this point. It certainly is encouraging … Food and energy is still influenced by energy prices. The Dallas Fed trimmed mean barely coming off its high. So we’re going to need some more evidence before we can say inflation is definitely moving down, but it’s encouraging us going in the right direction.”

“Now, a big factor in macroeconomics and inflation is inflation expectations. They’re relatively low, which I think is due to the front-loaded Fed policy during 2022. Something I advocated and others on the committee advocated was to move the disinflationary policy, be aggressive, try to get inflation under control as soon as we can so that we don’t repeat the 1970s experience where we let inflation linger for 15 years, culminating in the 1980, ’82 recession with unemployment rate at 10.8%. We don’t want to get into that kind of a fiasco. Let’s get inflation under control now while the economy’s performing relatively well, while the labor market is relatively strong. And if you look at inflation-based expectations, they are relatively low. According to standard macroeconomic theories, inflation expectations are a key determinant of actual inflation, what’s actually going to happen with inflation in the future.”

Jobs

“Unemployment is below its longer-run level … the unemployment rate can’t stay this low. Probably even if we did nothing, it can’t stay this low. It’ll probably move up to its more natural level somewhere in the mid-4% range.”