James Bullard, Speech: The Monetary-Fiscal Policy Mix and Central Bank Strategy

Press Release & Presentation Book –

Inflation

“The fiscal stimulus is receding, and monetary policy has been adjusted rapidly in the last year to better align with traditional central bank strategy. Accordingly, the prospects for continued disinflation are good but not guaranteed.”

“So far, core PCE inflation has declined only modestly from the peak levels observed last year.”

“The spirit of the macroeconomic policy response to the pandemic was to err on the side of too much rather than too little. This could be thought of as risking a high-inflation regime, as the monetary authority did not attempt to offset the inflationary impulse unleashed by the fiscal authority.”

Inflation Expectations

“An encouraging sign that the switch to pre-pandemic fiscal-monetary policy is working comes from market-based inflation expectations. These expectations were near 2% in the first quarter of 2021, before any inflation had appeared or was widely expected. After moving higher in the last two years, these expectations have now returned to levels consistent with 2% inflation.”

Fed Funds

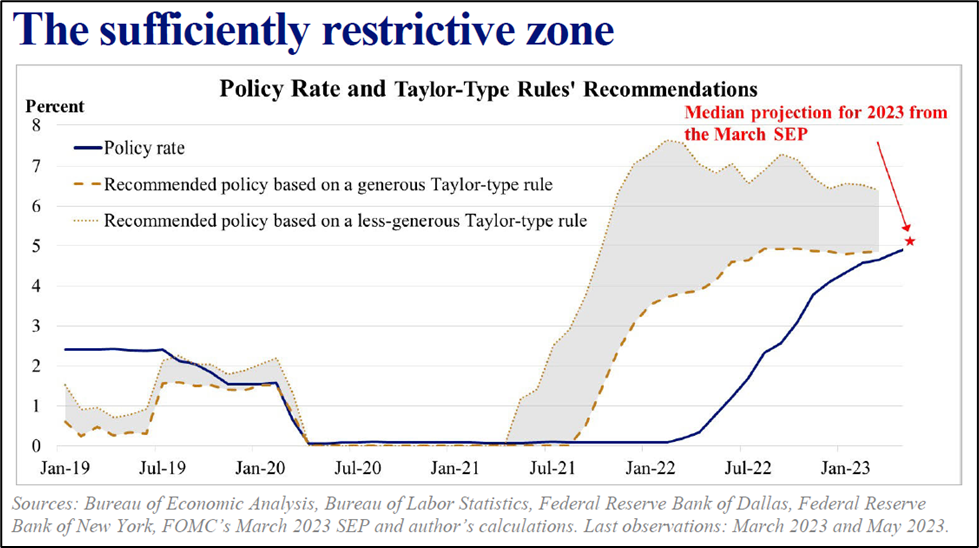

“Monetary policy is now at the low end of what is arguably sufficiently restrictive given current macroeconomic conditions.”

- Bullard’s sufficiently restrictive zone is between 4.9% and 6.4%.