CBO, Report: The Budget and Economic Outlook for2023 to 2033

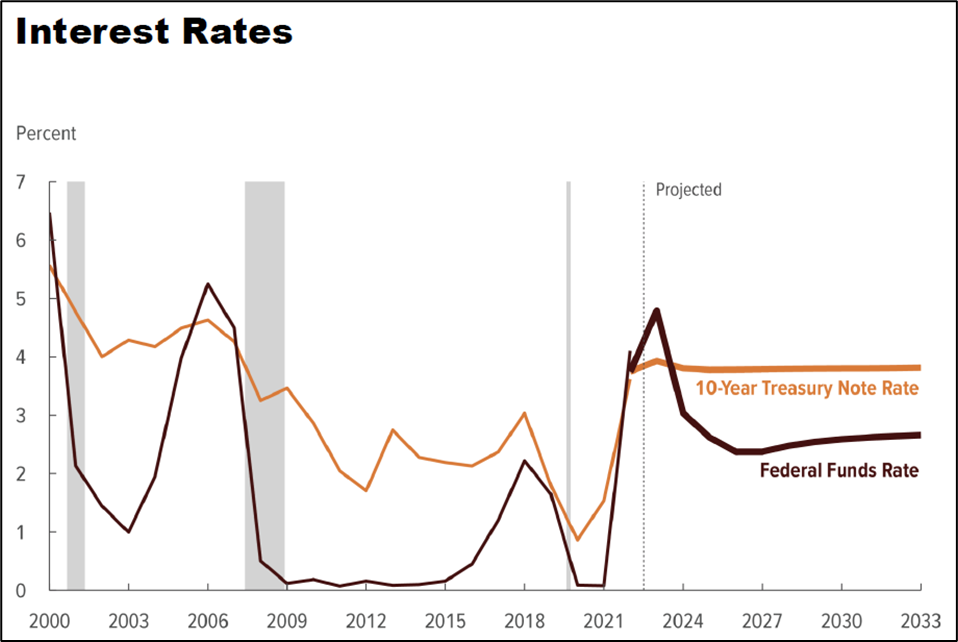

Interest Rates

“In CBO’s projections, the Federal Reserve further increases the target range for the federal funds rate in early 2023 to reduce inflationary pressures in the economy. That rate is projected to fall in 2024, as inflation slows and unemployment rises. The interest rate on 10-year Treasury notes, however, remains at 3.8 percent from 2024 to the end of the projection period.”

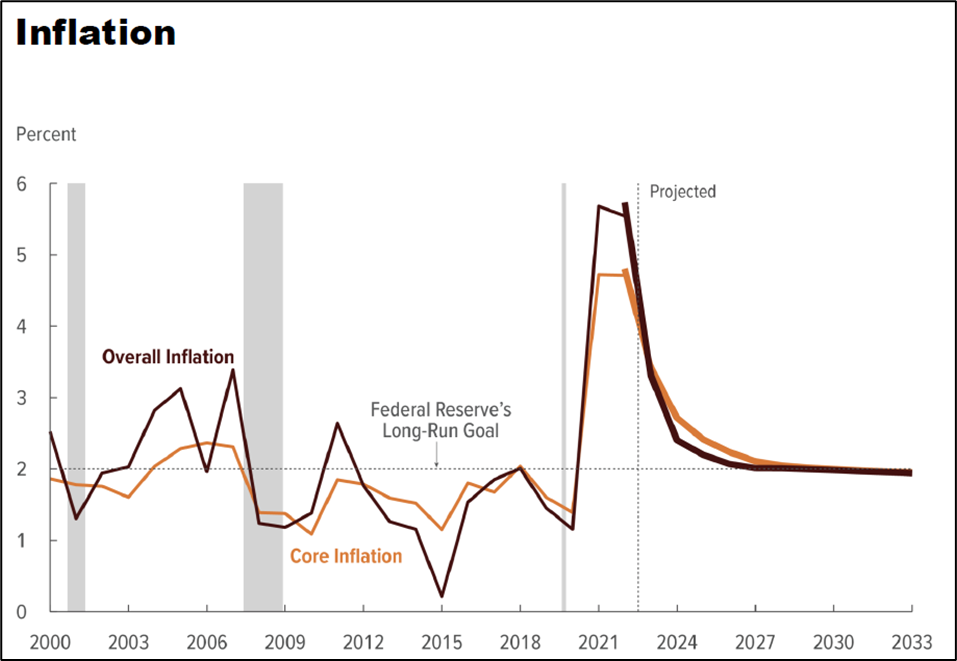

Inflation

“In CBO’s projections, inflation declines in 2023 as pressures ease from factors that, since mid-2020, have caused demand to grow more rapidly than supply. That decline continues until 2027, when the rate of inflation reaches the Federal Reserve’s long-run goal. (Inflation is measured by the price index for personal consumption expenditures.)”

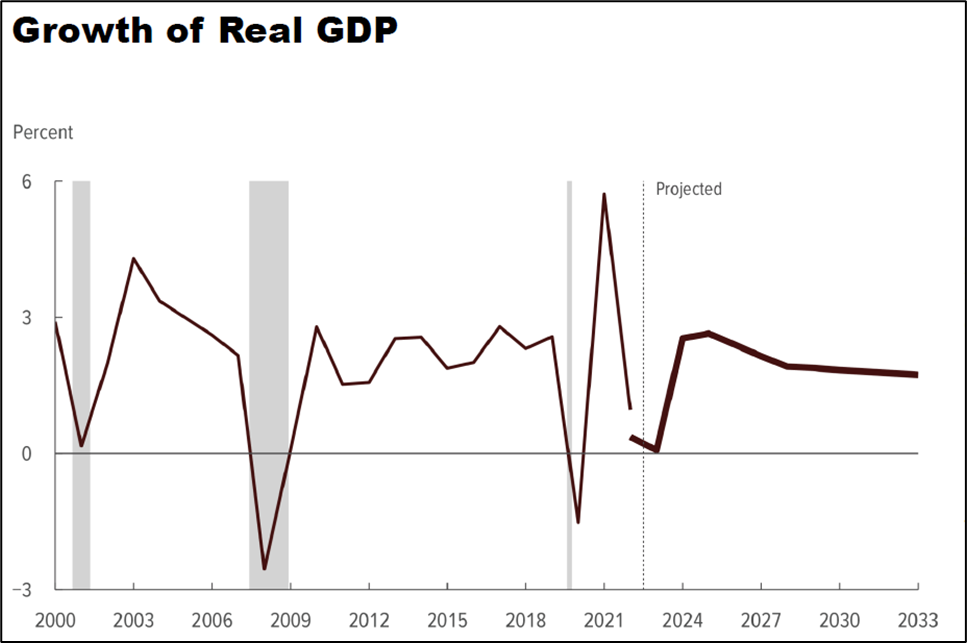

GDP

“In CBO’s projections, output growth comes to a halt in 2023 in response to the sharp rise in interest rates during 2022. Then, as falling inflation allows the Federal Reserve to reduce the target range for the federal funds rate, the growth of real GDP rebounds, led by the interest-sensitive sectors of the economy.”

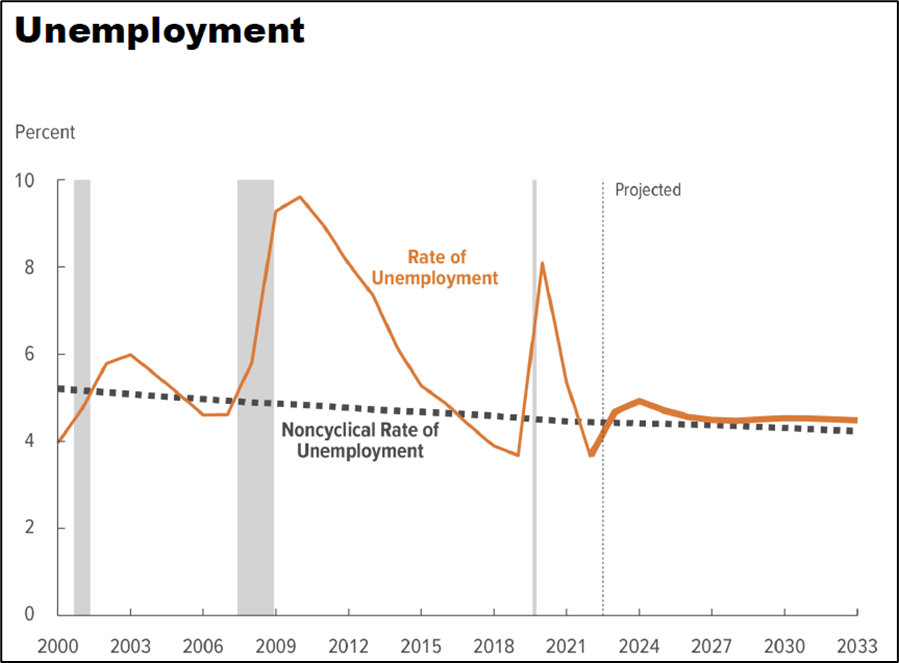

Jobs

“The unemployment rate rises through early 2024, reflecting the slowdown in economic growth. The rate falls thereafter as output returns to its historical relationship with potential output.”