James Bullard, Speech: Getting into the Zone

Inflation

“Inflation remains unacceptably high, well in excess of the Federal Open Market Committee (FOMC) target of 2%. Thus far, the change in the monetary policy stance appears to have had only limited effects on observed inflation, but market pricing suggests disinflation is expected in 2023.”

Restrictive Rate and Rate Hikes

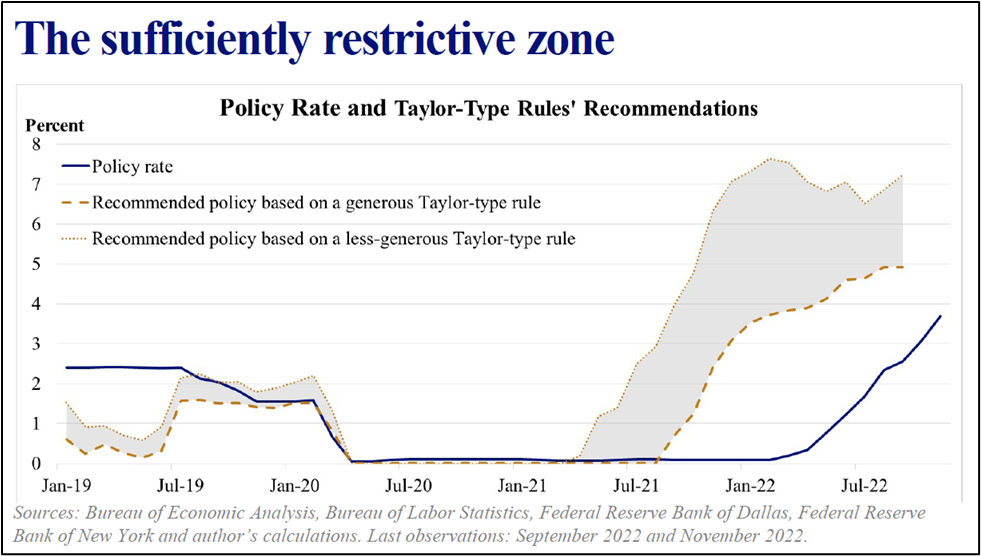

“My approach to this question is based on ‘generous’ assumptions—assumptions that tend to favor a more dovish policy over a more hawkish one. Even under these generous assumptions, the policy rate is not yet in a zone that may be considered sufficiently restrictive.”

“To attain a sufficiently restrictive level, the policy rate will need to be increased further.”

“The chart suggests that while the policy rate has increased substantially this year, it has not yet reached a level that could be justified as sufficiently restrictive, according to this analysis, even with the generous assumptions.”

- The chart shows a restrictive rate between 5.00% and 7.00%.

“The policy rate has been increased during 2022 but has lagged behind the increases in the recommended zone in the chart. The shaded area in the chart could decline as new data arrive—in particular, if inflation declines in the months and quarters ahead. Indeed, market expectations are for declining inflation in 2023. Caution is warranted, however, as both markets and the FOMC’s SEP forecasts have been predicting declining inflation just around the corner for the past 18 months.”

Rate Hikes and Financial Stress

“It is possible that increased financial stress could develop in such an environment. However, the transparency with which these [policy rate] increases have been delivered, along with forward guidance, seems to have allowed for a relatively orderly transition to a higher level of interest rates so far.”